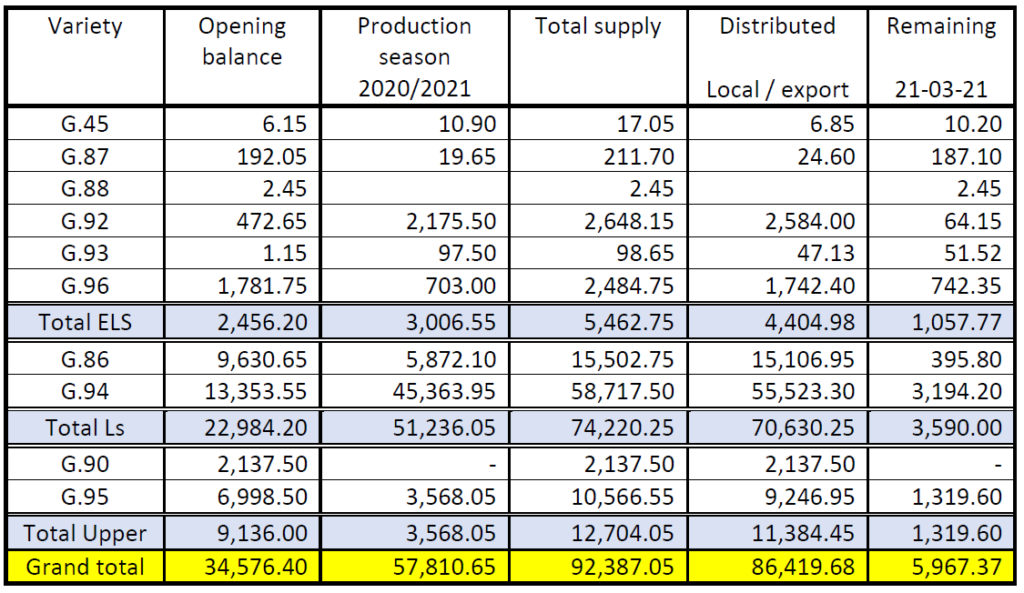

Statistical position of Egyptian cotton Season 2020/2021 (M.T)

From beginning of season till 21/03/2021

- Above report is based on CATGO statistical position (cultivation areas and Alcotexa commitment).

• 93 % from total crop has been sold (86,419.68 M.T) prices are expected to remain firm Mainly tight Giza supply position is driving prices higher.

• Within this week Prices increased to record above 162 C.L for G.94/G.86 with expected slightly

continues increase due to shortage of supply. as still 7 months for the arrival of new crop.

• Remain balance (5,967.37 M.T) include almost 50% from old crops. available quantities from new crop specially in Upper Egypt cotton and LS is very nominal.

• The Ministry of Agriculture and Land Reclamation decree No.71 for year 2021 announcing the

cultivation verities of season 2022 as (G.86-G.92-G.94-G.96-G.97-G.95).

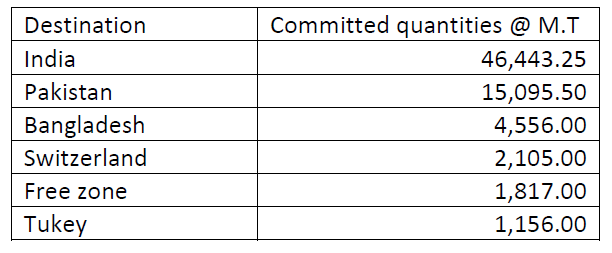

• 94 % of total sales is distributed among 6 destinations as under: –

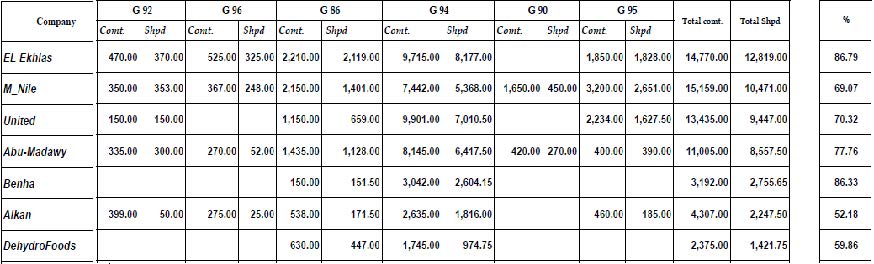

Commitment analysis week (25) Season 20/21

From 07/03/2021 to 20/3/2021

Above report as per Alcotexa weekly report.

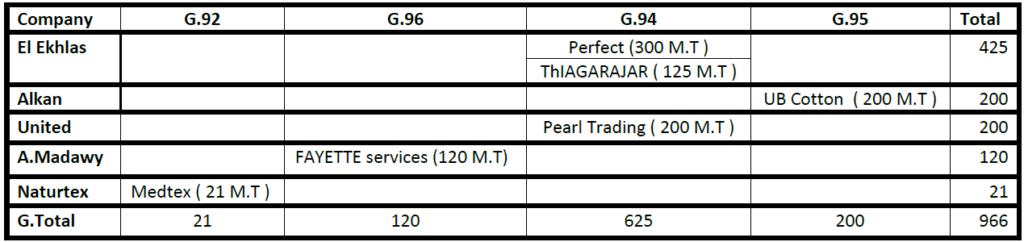

Physical fiber probertites for Egyptian cotton (GIZA) all varieties crop 20/21

Above data issued by CATGO for the average of all samples submitted for test

within the period 1st sep,2020 to 9th March,2021 based on HVI classing 1000 instrument.

Top 7 exporters – Commitments & shipped % (Season 2020/2021) By Ton From 01/10/2020 To 20/03/2021 as per Alcotexa weekly report

USA: –

Pima having increased from 124.00 cents/lb to 185.00 cents/lb within this season. The good demand for US Pima is unbroken which can be explained with a nearly empty supply chain.

For season 2021/22 the US Pima crop will be around 25% smaller compared to the previous

season due to a severe drought in the south of the San Joaquin Valley. This is the second year in a row

that this part of California is suffering from water shortage.

With this low crop, (- 25%) compared by previous season, it is clearly that Pima prices will remain high.

also, in season 2021/22. consumption is massively higher than production, which further reduces stocks. This trend will also continue in the 2021/22 season, which will further exacerbate the tight supply situation.

Crop 20/21 (in running bales of 500 lbs)

After net sales of 7’000 bales (India 3’100 bales, Austria 1’300, Honduras 1’300, Bangladesh 700, Pakistan 400 and various 200), 735’000 bales have been registered so far.

We have the following situation:

366’000 bales beginning stock Aug 1, 2020

514’000 bales estimated production 20/21 (estimate USDA on their WASDE report February 2021)

19’000 bales less domestic mill use

258’000 bales less outstanding sales

477’000 bales less accumulated exports

126’000 bales available for export

Out of 861’000 bales (total supply minus domestic mill use), which is the available quantity for export, 86% have been registered so far.

Cotlook US Pima Grade 2, 20/21: 178.00 c/lb (+ 2.00 c/lb) – shipment April/May 2021

China: –

China’s 2021/22 imports are forecast at 11.0 million bales, unchanged from the previous year’s level,

which was the highest level in 7 years. Further growth in yarn and fabric production, coupled with

lower domestic production, is expected to maintain strong imports in addition to the State Reserve

maintaining an optimal level of government-held stocks comprised of both imports and domestic

supplies. China’s consumption is projected to increase at a rate below the world average.

growth in 2020/21. China realized an earlier recovery from the impacts of COVID-19 relative to

other major consumers, with the resultant 2020/21 consumption growth rate above the world

average.

Chinese ELS situation as follows (in tons):

Crop 2020/21 Crop 2021/22

85,000 beginning stock 80,000

55,000 production 55,000

40,000 import 40,000

100,000 consumption 100,000

80,000 ending stock 75,0000

XJ ELS cotton is now much cheaper than imported ELS, the mills only use US Pima, Egyptian cotton if the order explicitly requires textiles without XJ ELS cotton (sanctions)